free cash flow yield explained

Free Cash Flow to Equity FCFE Free cash flow to equity FCFE is the amount of cash a business generates that is available to be potentially distributed to shareholders. Free cash flow FCF is the cash flow available for the company to repay creditors or pay dividends and interest to investors.

Unlevered Vs Levered Fcf Yield Formula And Excel Calculator

Free Cash Flow Operating Cash Flow CFO Capital Expenditures Most information needed to compute a companys FCF is on the cash flow statement.

. What is Free Cash Flow FCF. Free Cash Flow Yield FCFY We can take this relevant information and produce a ratio that is one of the most useful metrics in stock analysis. Amazon free cash flow for the twelve months ending December 31 2021 was a year-over-year.

The free cash flow in this example is negative. Free cash flow per share is a measure of a companys financial flexibility that is determined by dividing free cash flow by the total number of shares outstanding. As an example let Company A have 22 million dollars of cash from its business operations Cash Flow Cash Flow CF is the increase or decrease in the amount of money a business institution or.

Free Cash Flow to the Firm FCFF This is a measure that assumes a company has no leverage debt. During the past 3 years the average Free Cash Flow per Share Growth Rate was 2190 per year. Xiaomi OTCPKXIACF Free Cash Flow Explanation Free Cash Flow is very close to Warren Buffetts definition of Owners Earnings except that in Warren Buffetts Owners Earnings the spending for Property Plant and Equipment is only for maintenance replacement while in the Free Cash Flow calculation the cost of new Property Plant and Equipment due to business.

Alibaba free cash flow for the twelve months ending September 30 2021 was a year-over-year. The Free Cash Flow Yield Cash Flow Yield The free cash flow yield is a financial ratio that compares the free cash flow per share to the market price per share to determine how much cash flow the company has in the event of liquidation or other obligations. Instead of market capitalization it uses the price you paid for an investment as the denominator.

This ratio expresses the percentage of money left over for shareholders compared to the price of the stock. Its free cash flow per share for the trailing twelve months TTM ended in Dec. It is used in financial modeling and valuation.

The ratio is calculated by taking. Amazon annual free cash flow for 2021 was -9069B a 12924 decline from 2020. Cash may be King but FCF yield is an Ace.

Httpsamznto3LGhEoHMy favorite Investment Book. People sometimes describe this as free cash flow yield Cash on Cash Yield is a different measurement often used to evaluate real estate investments. This guide will provide a detailed explanation of why its important and how to calculate it and several.

Per Valuation 101 smart investing is about buying low expectations and selling high expectations. During the past 12 months the average Free Cash Flow per Share Growth Rate of CVS Health was 1590 per year. This measure serves as a proxy.

Thats the ratio of free cash flow to market cap. It is calculated as Cash from Operations less Capital Expenditures. Alibaba annual free cash flow for 2019 was 17678B a 116 increase from 2018.

Read more about FCFF Unlevered Free Cash Flow Unlevered Free Cash Flow is a theoretical cash flow figure for a business assuming the company is completely debt free with no interest expense. Investors who wish to employ the best fundamental. For example if you paid 100000 for a.

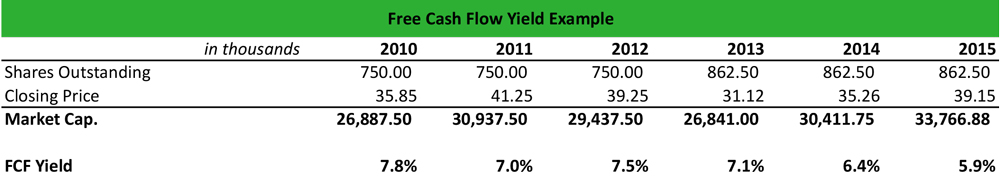

The value investors like Warren Buffett will stay away from such companies. Price to free cash flow is an equity valuation metric used to compare a companys per-share market price to its per-share amount of free. Free Cash Flow Yield Free Cash Flow Market Capitalization.

Free cash flow is a great tool to use for case study interviews and for returns analyses. Free cash flow yield offers investors or stockholders a better measure of a companys fundamental performance than the widely used PE ratio. Free cash flow yield is really just the companys free cash flow divided by its market value.

Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period. We need a metric that tells how highly the market is. Free cash flow yield is a financial ratio which measures that how much cash flow the company has in case of its liquidation or other obligations by comparing the free cash flow per share with market price per share and indicates the level of cash flow company is going to earn against its market value of the share.

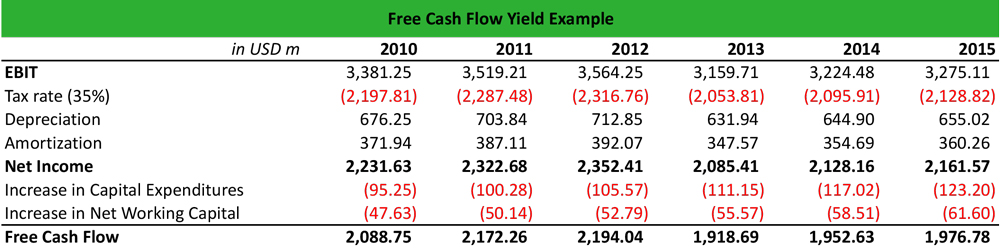

Free Cash Flow is an important metric but the level of FCF by itself does not provide enough information for an investment strategy. Free Cash Flow as of today March 22 2022 is Mil. Free Cash Flow Yield Explained Although IRR and MoM often reign supreme as the most popular private equity return metrics Free Cash Flow Yield is also a very powerful investment metric.

To break it down free cash flow yield is determined first by using a companys cash flow statement. In depth view into Free Cash Flow explanation calculation historical data and more. Using free cash flow yield to measure the sustainability of a company may produce potentially higher returns and more attractive upsidedownside capture overtime.

Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn against its market value per share. Free cash flow is really free cash available with the owners of the company. Alibaba annual free cash flow for 2020 was 2381B a 3469 increase from 2019.

Httpsamznto35cbAn0Fundsmith founder Terry Smith explains free cash-flow yield. Though the company looks profitable in the PL account a negative FCF will yield it only zero intrinsic value. Free Cash Flow Yield.

Alibaba annual free cash flow for 2021 was 35434B a 4882 increase from 2020. Amazon annual free cash flow for 2020 was 3102B a 2012 increase from 2019. Amazon free cash flow for the quarter ending December 31 2021 was -906900 a year-over-year.

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow To Equity Fcfe Levered Fcf Formula And Excel Calculator

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Unlevered Free Cash Flow Definition Examples Formula

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow Meaning Examples What Is Fcf In Valuation

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow Uses One Of The Most Important Metrics In Finance

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

What Is Free Cash Flow Yield Definition Meaning Example

What Is Free Cash Flow Yield Definition Meaning Example

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Cash Flow Formula How To Calculate Cash Flow With Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow To Firm Fcff Unlevered Fcf Formula And Excel Calculator

Free Cash Flow Yield Fcfy Formula Examples Calculation Youtube

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator